The new vehicle market declined by 3,5% with aggregate industry new vehicle sales at 35 948 units compared to the total new vehicle sales of 37 250 units during the corresponding month of December 2020.

The December 2021 new passenger car market and light commercial vehicle market reflected a mixed performance with a year-on-year volume increase of 1,7% in the case of new passenger cars and a decline of 16,6% in the case of light commercial vehicles.

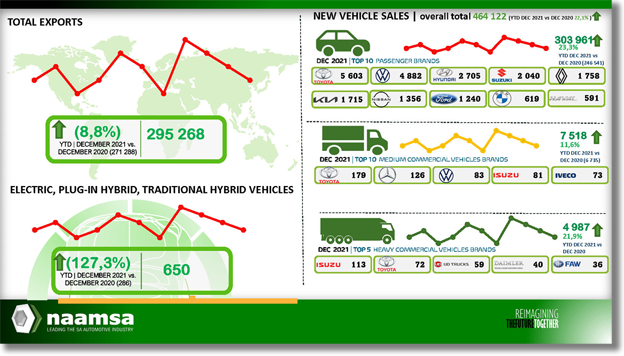

Sales of medium commercial vehicles increased year-on-year by 17,5% while heavy commercial vehicles and buses were marginally down by 0,7%.

Export sales ended the year on a positive note recording a welcomed increase in December 2021 and at 21 430 units reflected a gain of 3 487 vehicles or an increase of 19,4% compared to the 19 943 vehicles exported during December 2020.

Overall, out of the total reported industry sales of 35 948 vehicles, an estimated 33 160 units or 92,2% represented dealer sales, an estimated 4,9% represented sales to the vehicle rental industry, 1,9% to government, and 1,0% to industry corporate fleets.

Commenting on the sales, NAAMSA: The Automotive Business Council, said: “It was a very satisfying performance by an industry that has had to deal with numerous challenges over the course of the year, ranging from global supply chain disruptions, insufficient model availability, persistent load-shedding, escalating logistics cost, as well as several domestic shocks.

“Fortunately, the domestic new vehicle market’s resilience continued, and the domestic economic disruptions caused by the civil unrest, the cyberattack on Transnet operations, the three-week strike in the steel and engineering sector, the adjusted alert level 4 lockdown restrictions during the second half of the year as well as record fuel prices and a first interest increase in three years did not deter sales too much.

“Renewed activity in the vehicle rental industry, which is a major seasonal contributor to the new vehicle market, supported passenger car sales during the second half of the year as the country’s economy started to open up to overseas visitors.

“Overall, market conditions in the new passenger car and light commercial vehicle market continued to be characterised by a buying down trend, with sales of preowned vehicles offering the most enticing option during the year. Sales of medium and heavy commercial vehicles also reflected signs of resilience and the sales performance mirrored the improved macro-economic climate in the country.”

NAAMSA added it was inconceivable that, during our lifetime, a virus such as COVID-19 would radically and precipitously change the world we live in and bring global economies to an upsetting slowdown.

“The year 2021 was a year characterised by further waves and variants of the Coronavirus as well as several domestic challenges. The South African automotive industry like many other businesses, had to learn to quickly adapt to constantly changing regulations at the different alert levels.

“We had to embrace remote and flexible working environments and we had to find new ways to operate in a dynamical digital economy. Many of our companies had to reimagine and reinvent themselves to remain relevant and as a result, they managed to remain resilient in recouping some of the losses in new vehicle sales, vehicle exports and vehicle production compared to the severely COVID-19 affected 2020 levels.”

Commercial vehicles sales are traditionally a barometer of business confidence within the country and the rather rollercoaster movement of these during December and the months preceding tells a sorry tale, albeit one with some hope and resilience.

Fleet and corporate buyers that, traditionally, account for more than 85% of all new vehicle sales each month, cut back on new vehicle buying and extended the operating life of their vehicles – a short-term solution to business issues but one that can compound over time by reducing the numbers of quality low-mileage used vehicles into the market.

This, in turn, starts to put pressure on the prices of used vehicles and they rapidly increase creating something of a vicious circle.

“While the new vehicle market has seen substantial growth since the initial shock, it has not been sufficient to return to pre-COVID-19 levels in 2021,” says NAAMSA.

“A sustained higher domestic economic growth rate is essential to support higher domestic new vehicle sales volumes. However, with a GDP growth rate forecast of a moderate 1,8% in 2022, the new vehicle market is expected to continue its gradual recovery during the year, but at a slower pace and at this stage a year-on-year improvement of around 8% in aggregate new vehicle sales volumes is projected for 2022.

“Factoring in the expected year-on-year improvement in vehicle exports of around 15%, an improvement in industry vehicle production of about 17% is projected for 2022.

“The automotive industry is not only the largest manufacturing sector in the South African economy, but it also invests billions of Rand every year, and represents about 460 000 highly skilled, direct jobs in its formal sector supply chain. With constant economic shifts and global disruptions, the order of the day, companies must capitalise on smart business models that will fuel their growth matrix.”